Abolishing Property Taxes: Pennsylvania’s Moonshot

I introduced HB900 last week, and you should understand why I did what I did. And why I didn’t do what I didn’t do.

[Note: This is my third column on abolishing property taxes in Pennsylvania. You should also read the previous two by clicking here and here. Go ahead; I’ll wait.]

On May 25, 1961 in a speech before a joint session of Congress, President John F. Kennedy announced:

“I believe that this nation should commit itself to achieving the goal, before this decade is out, of landing a man on the Moon and returning him safely to the Earth.”

A year and a half later in a speech at Rice University he declared:

"We choose to go to the Moon in this decade and do the other things, not because they are easy, but because they are hard."

When JFK first committed to the moonshot, American human beings had spent a whopping 15 minutes in space. There was no Apollo program. There was no lunar lander. No human had ever left Earth’s orbit. But he assessed the existing capabilities and potentials of the time, and set a deadline.

On July 20, 1969 that objective was partially realized when Neil Armstrong set foot on the moon, and four days later it was fully realized with the safe splashdown of Apollo 11 in the Pacific Ocean.

Deadlines Work

I am certainly no JFK, but I do know that deadlines work. When you set a deadline, it makes people start thinking along the lines of ‘how do we get there from here?’

JFK simply said an American is going to the moon and back before 1970. He didn’t say how much thrust it would take to escape Earth’s orbit. He didn’t calculate the angle the lunar module would need to take on its landing path to Tranquility Base. He didn’t display the suit Neil Armstrong would wear as he took one giant leap for mankind.

All of those things had to be figured out in the decade to come. And they were. Because they had a deadline.

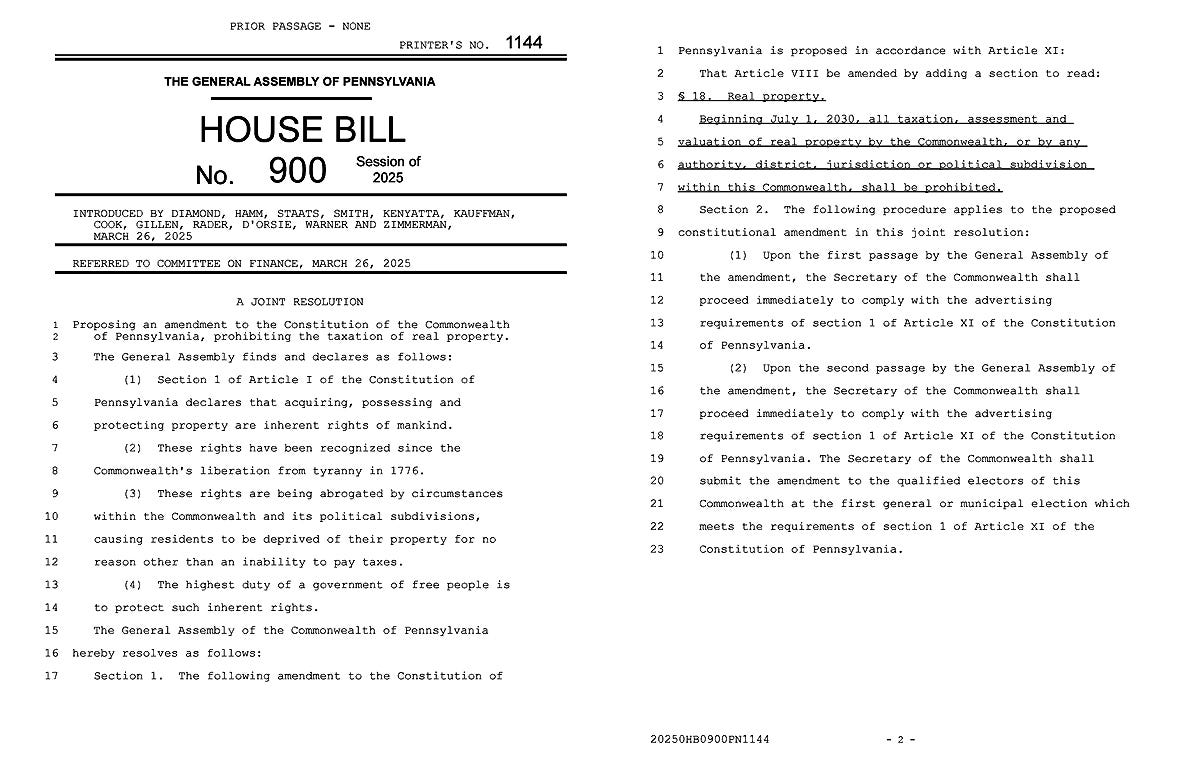

HB900, my constitutional amendment to abolish all property taxes in Pennsylvania serves as a deadline. It also serves as a point of agreement on an objective for all Pennsylvanians and a homework assignment for your servants in the General Assembly. It’s Pennsylvania’s moonshot.

Why a Constitutional Amendment?

A constitutional amendment is the only way to abolish property taxes. You wouldn’t want the General Assembly to abolish them by statute (regular legislation), because what we do by statute today, we can just as easily undo with another bill tomorrow.

A constitutional amendment is a more permanent change which is far more difficult to undo. I certainly don’t want to go to all the effort only to have some future legislator reinstate property taxes on a whim after I’m gone. I want to abolish them permanently.

For those who don’t understand the process of amending the Pennsylvania Constitution, it is not accomplished the in the same manner as a regular bill creating statutory law.

Regular bills need to get approved by simple majorities in the House of Representatives and the Senate and then are sent to the Governor for his signature or veto. If he signs it - voilà! - that bill becomes a law. That can all happen rather quickly, and sometimes it does.

Constitutional amendments, on the other hand, need to be approved by simple majorities of the House and Senate in two successive legislative sessions in the exact same form, and then are sent to the ballot for voters to approve or reject. The Governor plays no role in the process.

A constitutional amendment takes longer to get done than a regular bill because legislative sessions last two years in Pennsylvania. And it is much more difficult because the political makeup of the General Assembly can change drastically from session to session.

July 1, 2030?!?!?

The effective date for abolishing property taxes is probably the first thing people notice when they actually read HB900. July 1 of 2030??? WTH? That’s more than five years away!!!! Why do we have to wait so long? Why can’t we do it sooner? Why are you stalling?

Allow me to explain the reasoning behind that effective date.

First, as a constitutional amendment this bill will have be approved by both the House and Senate not just during the current 2025-26 legislative session, but also during the 2027-28 legislative session.

If approved now by both the House and Senate, we’d still have to wait until the beginning of 2027 to approve it a second time. Depending on the politics of the moment, that might not happen until the end of 2028. If so, then it wouldn’t be able to appear on the ballot for voters to approve or reject until May of 2029.

Second, I chose July 1 rather than January 1 (or any other date of the year) because the entities that currently collect property taxes – school districts, counties, and municipalities – have fiscal years that begin on July 1 every year. Swapping out revenue collection methodologies in the middle of their fiscal year would cause unnecessary headaches and havoc.

Finally, I chose 2030 as the year of the effective date because if HB900 doesn’t appear on the ballot until May of 2029, that’s a little too close to the beginning of a new fiscal year. Adding another year to the timeline gives all our school districts, counties, and municipalities ample time to get their ducks in a row to be funded in a different manner.

I have no interest in creating unnecessary headaches or havoc for anyone while making such a major change. When change is rushed, mistakes are made.

BuT hOw WiLl We FuNd GoVeRnMeNt?!?

The second most popular response to HB900 is a demand to know how exactly school districts, counties, and municipalities will be funded. Right here, right now, dadgummit!

First, it would not be proper to include a revenue replacement scheme for all of Pennsylvania’s 499 school districts, 67 counties, and 2650 municipalities in this singular constitutional amendment. That will need to be done by statute, and it will require several different statutes depending on the particular replacement scheme we settle on.

Second, while I certainly have my own opinion on how to best fund those school districts, counties, and municipalities without property taxes, it is not my desire to impose my will on everyone. I’d much rather have a public discussion about it so we can come to some reasonable consensus on the matter.

Further, during the course of that public discussion we can also delve into ways to fix our other broken tax systems in Pennsylvania (believe me, they’re ALL pretty screwed up), as well as address the recent court ruling that the way we fund schools is unconstitutional, examine ways to create cost savings by consolidation of services, and perhaps devise brand new ways of governance that don’t even exist now.

Wouldn’t you like to have a say in all those things rather than have a bunch of legislators just shove something down your throat?

And finally, it doesn’t all have to be set in stone today. It does all have to be in place before July 1, 2030, though. I certainly don’t want to bring public education to a screeching halt, shut down the 911 call centers and jails that our 67 counties operate, or cancel the local garbage collection and snow plowing provided by municipalities.

The Final Countdown

Here’s the one thing I am absolutely sure about: If we don’t get started by having the House and Senate approve the first passage of HB900 during the 2025-26 legislative session, we’ll have to reset the clock on Pennsylvania’s moonshot by changing the deadline to July 1, 2032 when I reintroduce the bill during the 2027-28 legislative session.

SIDEBAR: When I first introduced this constitutional amendment during the 2015-16 legislative session, the effective date was set for July 1, 2022. Had we started the process back then, you would be nearly three years into actually OWNING your property and not paying rent to the government already. Wouldn’t that be awesome?

The beauty of doing this as a constitutional amendment is that ultimately, voters can REJECT the whole mission at the ballot box. None of the statutes that will need to be approved to create new funding methods for school districts, counties, and municipalities would need to have an effective date before July 1, 2030 and would be contingent upon final approval of the constitutional amendment by the voters.

The Negatarians

I’ve seen a lot of people opine that abolishing property taxes will never happen. I can certainly understand their sentiment and distrust of Harrisburg, but I prefer to live by the words of Winston Churchill:

“For myself, I am an optimist – it does not seem to be much use being anything else.”

We are in a much better position for this moonshot than JFK was for his. We already know how much it costs to run our schools, counties, and municipalities. We already have other methods for funding them, even if they each need to be repaired. And we know exactly what our proverbial moon’s surface is made of: actual OWNERSHIP of our property as opposed to renting it from government forever.

That last bit is worth all the effort, imagination, and public discourse it will take to get there. It all starts with a deadline, and that’s exactly what HB900 is. If you want to set a deadline, we need to start now.

Take the Property Tax Poll!

Based on comments I’ve seen over on Facebook, people generally fall into four different categories in response to HB900:

Many just want to OWN their property rather than renting, and support launching the moonshot now by having the General Assembly get to work the on the first passage of HB900.

Others believe they’re part of a special class of citizens who deserve to pay less taxes than the rest of us, so their support of the HB900 moonshot depends on whether they’ll get a free ride.

Others have no imagination and won’t agree to setting the HB900 moonshot deadline until they know Every. Single. Detail. about hOw WiLl We FuNd GoVeRnMeNt?!?!?

And then there are a few who love renting their property from the government – no HB900 moonshot for them!

That’s all for now. My next property tax column will take a look at how screwed up ALL our systems of taxation in Pennsylvania really are. Stay tuned!

Agree? Disagree? I want to hear from you! Leave a comment or send a reply email!

If you’re not following already, you can follow my official legislative Facebook page by clicking here. Come for the content, stay for the comments. Sometimes it gets a little heated over there!

I've been following your Facebook posts and I totally understand why it needs to be done this way. I'm for it and I'm really hoping others look into it so they see the possibility of promise in the future. This needs to be done right and I believe it is! Thank you!

Read this and I think it’s sounds Great. Tried of paying rent every year. I want to also say thank you all you are doing. This is a Big Deal. Very appreciated. Thanks again.