On Abolishing Property Taxes

Some facts, figures, myths, and observations to help explain why abolishing ALL property taxes in Pennsylvania is the only solution.

Anytime I post about abolishing property taxes in Pennsylvania on social media, I get all manner of commentary from folks coming at it from different angles, so I wanted to take some time to address some of the most common of them.

But first, some facts.

When I talk about property taxes, I’m talking about annual taxes on real estate. If your real estate is mortgaged, your lender likely gets the bill and you pay into an escrow account as part of your monthly mortgage payment to cover the cost. If your real estate is fully paid off you get those bills in your mailbox, and you need to write a big fat check when they arrive.

The state does not collect property taxes. Property taxes are collected by your school district, your county, and your municipality to help fund the services those entities provide. The state grants those entities the authority to collect those taxes. But if you fail to pay them for three consecutive years, the sheriff will initiate legal action to sell your property in an effort to collect what you owe.

According to a 2023 Independent Fiscal Office report, all those property taxes amounted to about $22 billion per year in collections back in 2021 (certainly higher now, in 2025). About $16.5 billion currently goes to fund school districts, with the balance split between counties and municipalities. These figures account for property taxes on both homes and business properties.

So property taxes as we know them are actually three different taxes. You might get these bills directly in your mailbox, or you might be paying them as part of your mortgage. If you rent instead of own, property taxes are definitely built into your monthly rent.

County Assessments

In order to determine how much property tax is owed, every property has to be assessed for its value. Your county is responsible for conducting that assessment, upon which the county, school district, and municipality all set a millage rate to generate the revenue they need to fund operations. (1 mill = $1 in tax per $1,000 of a property's assessed value.)

Those countywide assessments are complicated and cost millions of dollars. There is no other major tax system in Pennsylvania where millions of dollars are spent simply to determine how much tax is owed.

Everyone Pays, But Not At the Same Rate

No matter where you live or do business in Pennsylvania, you’re paying property taxes either directly or indirectly. Some properties are exempt from taxation: churches, government-owned properties, educational institutions, non-profits. Generally speaking.

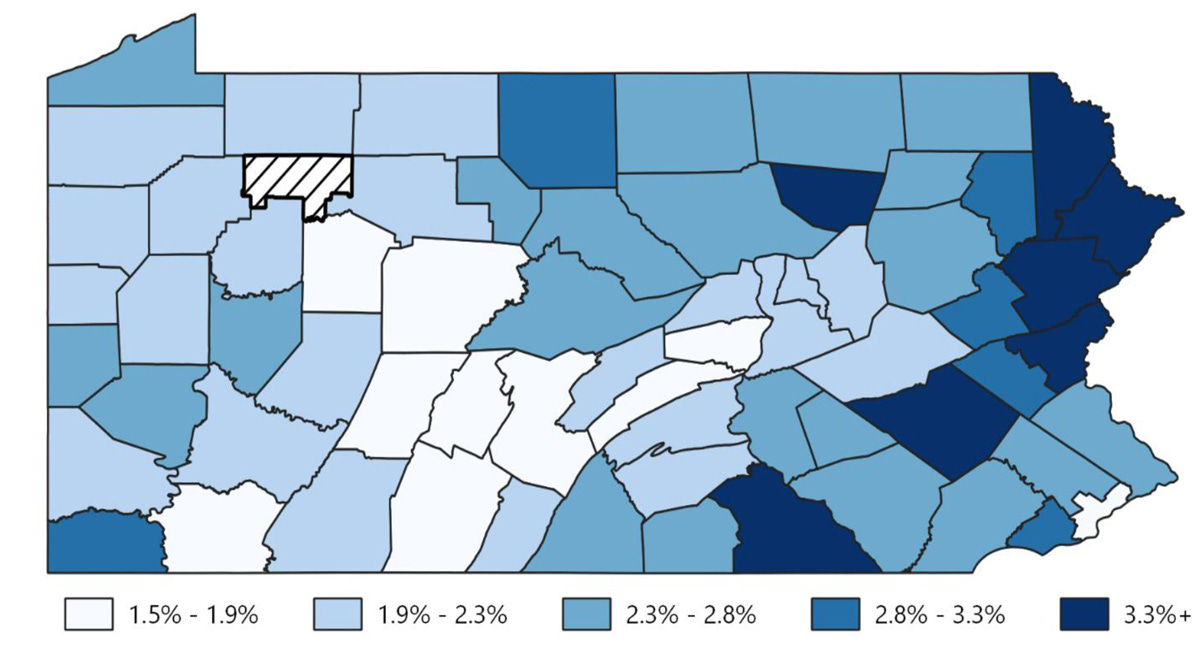

But how much you pay definitely depends on where you live. As seen on the map below, your overall property tax burden as compared to your total income varies greatly depending on what county in which you live and do business. Again, generally speaking.

Can It Be Fixed?

Few disagree that there’s a property tax problem in Pennsylvania, and the General Assembly has initiated attempts to “fix it” (off and on) for nearly half a century. My position is that the property tax system cannot be fixed, and therefore should be completely abolished. Permanently. With a constitutional amendment prohibiting ALL property taxes as of a future date certain.

Why Not Just Get Rid of School Property Taxes?

It’s true that school property taxes represent the lion’s share of the burden for most Pennsylvanians, but getting rid of those still leaves in place the expensive and inexact assessment process for counties.

Where I live in Lebanon County, the last reassessment in 2012 cost county taxpayers approximately $3 million, or around $55 per parcel. But those assessments, even at their best, are merely snapshots in time; they do not perpetually reflect the true value of property. Markets fluctuate, people make improvements, neighborhoods go to hell, surrounding land use changes, and those assessments are out of date nearly as soon as they are set.

Counties are not required to do regular reassessments to keep them up to date. Before 2012, the last time Lebanon County did a countywide reassessment was in 1972. That’s a lot of time for property values to change substantially, and in a vastly different manner for every single property. To keep every assessment on every property in every county up to date (and fair!) would be a huge burden on taxpayers.

Seniors Have Already Paid Their Fair Share!

As someone approaching my golden years I can certainly appreciate this sentiment, but calls for no property tax for senior citizens would violate the uniformity clause of the Pennsylvania Constitution, which states that “all taxes shall be uniform, upon the same class of subjects, within the territorial limits of the authority levying the tax” (Article VIII, Section 1).

The class of subjects at play here is property owners. You can’t be billed at a tax rate lower than any other property owner simply based on your age. The state has some programs, as do some larger jurisdictions, to provide discounts and rebates for seniors, those with disabilities, and disabled veterans, but they all have to be initially taxed at the same rate as every other property owner.

I Don’t Have Kids In School, Why Should I Pay?

As someone who has no children I can appreciate this sentiment as well, but it’s generally accepted that having a literate population is beneficial to society as a whole, whether you have kids or not. As a business owner, I agree with that sentiment. Pennsylvania needs to have an employable population. And again, the uniformity clause comes into play requiring all property owners to be taxed at the same rate.

Casinos Were Supposed to Eliminate Property Taxes!

Yeah, no one ever said that. Governor Ed Rendell once proclaimed that he could reduce property taxes by 30 percent while “standing on his head” if slot machines were legalized in Pennsylvania, but no one ever promised full elimination. Ed was vastly exaggerating, a practice all too common among politicians who are trying to get something done.

In 2024, taxes on casino revenues provided roughly $1 billion in school property tax relief for homeowners in Pennsylvania. If you look at your school property tax bill, it should be listed on there as the homestead or farmstead exclusion. Mine was $127.64 last year. Yours was probably a different amount; it’s different for every school district. If you’re paying a mortgage, you probably never even see the bill or the amount of your share of that $1 billion.

And $1 billion does not even come close to the $16.5 billion collected in school property taxes, but it is exactly the amount of relief that was proscribed and dedicated for school property tax relief when the Gaming Act was passed into law back in 2004. If slot machines generate more money, there will be more property tax relief.

Just Legalize Marijuana to Wipe Out Property Taxes!

That’s a pipedream. Even if Pennsylvania did that, revenue estimates for the state – at best – are only somewhere between $300-500 million per year from legal pot. Not even close.

Just Raise the Sales Tax By 1% to Wipe Out Property Taxes!

This is a mathematical myth. At 6 percent, the PA sales tax as we know it generated $14.4 billion in 2024. You’d have to raise the sales tax to 13 percent just to replace the school property tax burden, and your county would still have to conduct the very expensive and inexact property assessments.

Just Raise the Income Tax By 1% to Wipe Out Property Taxes!

Another mathematical myth. At 3.07 percent, the personal income tax as we know it generated $18.1 billion in 2024. You’d have to nearly double the income tax rate to almost 6 percent to replace the school property tax burden, and counties would still be stuck conducting property assessments.

It Cannot Be Fixed

The General Assembly has tinkered, toyed, and nibbled around the edges of the property tax problem for nearly half a century, and guess what? Property taxes continue to skyrocket no matter what! And once your property is paid off, you’re still essentially renting from the government!

With property tax, not all Pennsylvanians are being taxed uniformly. Where you live or do business shouldn’t impact whether you can afford to keep your property or not. Countywide assessments are expensive and inexact. The system is broken. It cannot be fixed. Property taxes should not be reduced, nor reformed. They need to be abolished. Permanently. And the only way to do that is with a constitutional amendment.

The Aftermath

If your property is already paid off, imagine how nice it will be to actually own it and not have to pay rent to your school district, county, or municipality! If your property isn’t paid off, imagine what it will be like to have a lower (perhaps substantially, depending on where you live) mortgage payment! If you currently rent there’s a pretty good chance that without property taxes, the market will quickly dictate lower rental rates. On top of that, if you want to purchase a property your ability to secure financing will likely become easier.

BuT hOw WiLl We FuNd GoVeRnMeNt?!?

The constitutional amendment process in Pennsylvania takes a minimum of three years before a question can appear on the ballot for voters to approve, because the General Assembly first has to approve it in two successive legislative sessions. It could take as long as five years. My proposal sets a date of July 1, 2030 for property taxes to be abolished. That gives us plenty of time in Harrisburg to figure out how to fund schools, counties, and municipalities.

Yes, there will have to be a tax shift. But as broken and antiquated as the property tax system is, I’m here to tell you Pennsylvania’s other systems of taxation are just as broken and antiquated. The sales tax system is very broken; the income tax system is somewhat less broken, but broken nonetheless. But at least with those systems, it doesn’t cost millions to pay for inexact assessments just to figure out how much tax is owed.

With a deadline five years away, we can take the opportunity not only to devise a new way to fund local governance, but repair those tax systems as well. More on that later…

Agree? Disagree? I want to hear from you! Leave a comment or send a reply email!

If you’re not following already, you can follow my official legislative Facebook page by clicking here. Come for the content, stay for the comments. Sometimes it gets a little heated over there!

Not good for me! I'm 82. I'll be dead. I was hoping maybe it would be gone. Maybe I could have money for a vacation before I die. Not nice worry everyday if I'll have the tav money.

I agree with abolishing property taxes but, honestly not within 5 yrs thats ridiculous. Whos kicking the can here in PA in order to feed the swamp and steal from property owners?

Someones not doing their job.