Did You Get the Short End of the Stick?

Here's a chart to see where your gaming-related property tax relief stacks up compared to other Pennsylvanians.

It seems that some folks missed the the link to the PDF that listed gaming-related tax relief figures for all 500 school districts in my last post, so I created a better table below so you can find the figures for your own school district.

Bottom line: If the tax relief amount for your school district is not at least $325, you’re getting the short end of the stick. If your school district’s tax relief amount is more than $325, you’re getting it at the expense of those who don’t.

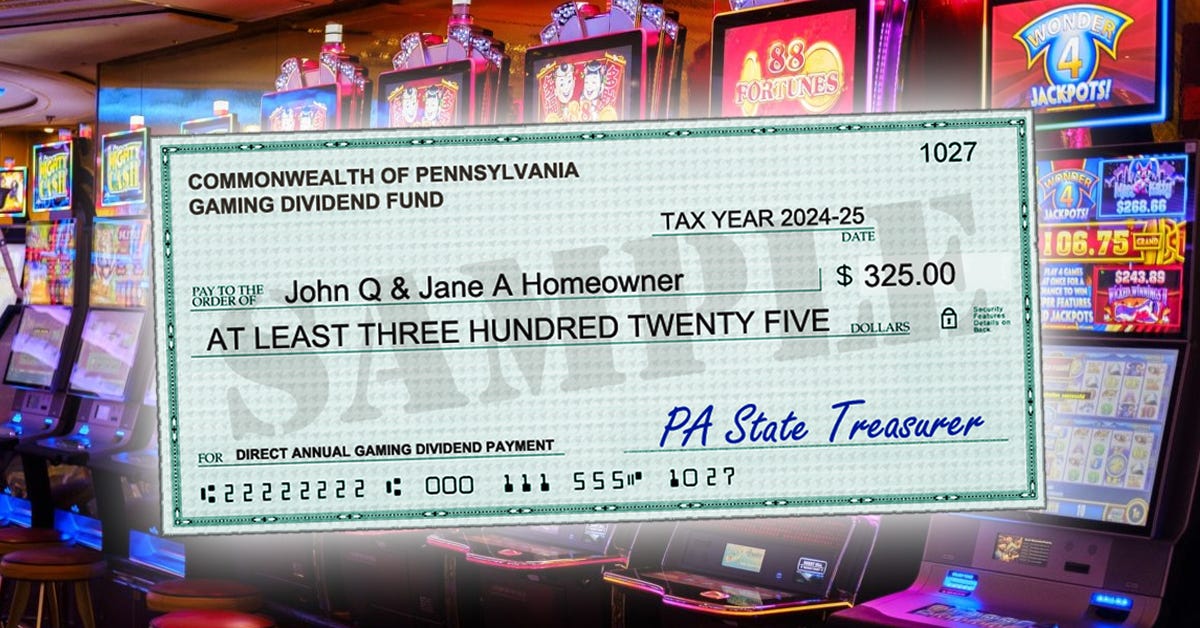

Last year 1,805,177 homeowners got less than $325, while 1,059,963 got more than $325 due to a convoluted formula devised by Harrisburg politicians back in 2006. That ain’t right, and it’s why I’m working on a plan to make sure every qualified homeowner gets the same amount via a DIRECT ANNUAL GAMING DIVIDEND PAYMENT.

If you’re a homestead/farmstead owner, this property tax relief is listed somewhere on your school property tax bill. Those bills only come out once a year around July 1st, and if you have a mortgage you probably won’t even see it because your lender gets the bill.

I think the Commonwealth should just mail you a check or make a direct deposit to your bank account instead. That way you’ll be certain you’re getting what you deserve every year.

Agree? Disagree? I want to hear from you! Leave a comment or send a reply email! If you’re not following already, you can follow my official legislative Facebook page by clicking here. Come for the content, stay for the comments. Sometimes it gets a little heated over there!