Do you remember before legalized gambling came to Pennsylvania, how politicians made all sorts of promises about how it would drastically reduce property taxes for homeowners? We all now know that was pretty much a sham.

While those promises turned out to be mostly smoke and mirrors, homeowners do get some benefit from legalized gambling via the homestead/farmstead exclusion. Unfortunately, as evidenced by the comment sections on this Facebook post, as well as this one, many people don’t really understand if they get it, or even where to look to find out.

[Hint: It’s listed on your annual school property tax bill. Those bills are issued around July 1st every year, kind of like an annual ransom note. If you have a mortgage, chances are you don’t even see the bill because your lender receives it.]

I finally got my hands on some realistic numbers for the impact gaming revenue has had on school property tax bills across Pennsylvania. Last year, gaming activities produced $931,060,391.72 tagged for tax relief, and there were roughly 2,865,140 homestead/farmstead properties that qualified for relief across PA. If you average that out, it amounts to about $325 per homeowner.

BUT!!!

Due to an extremely convoluted distribution formula devised by politicians in 2006 (almost a decade before I was elected), not every homeowner gets the same amount. Under their scheme, $474,540,285.28 (51%) of the money went to about 1,059,963 (37%) homeowners, all of whom receive more than $325, while the other $456,520,106.44 (49%) was left for the other 1,805,177 (63%) homeowners, all of whom receive less than $325.

In the Allentown City School District homeowners got $954, while in Bryn Athyn School District homeowners got $0. To me, this seems like nothing more than a wealth redistribution scheme by politicians who were trying to paper over the horrific unfairness of the property tax.

Here in Lebanon County, here’s what that distribution scheme means for homeowners in each of our six school districts. I’m listing each school district, the dollar amount of the homestead/farmstead exclusion, and where that school district ranks among the 500 school districts of PA:

Annville-Cleona SD - $127 (479th)

Cornwall-Lebanon SD - $181 (427th)

Eastern Lebanon County SD - $126 (480th)

Lebanon SD - $718 (9th)

Northern Lebanon SD - $210 (372nd)

Palmyra Area SD - $87 (498th)

Here’s a complete listing of all 500 school districts in Pennsylvania with their rankings:

TAKING SIDES

I’m going to side with the 1,805,177 Pennsylvania homeowners who are getting the short end of the stick, which includes every single homeowner in the 102nd District, the area I represent.

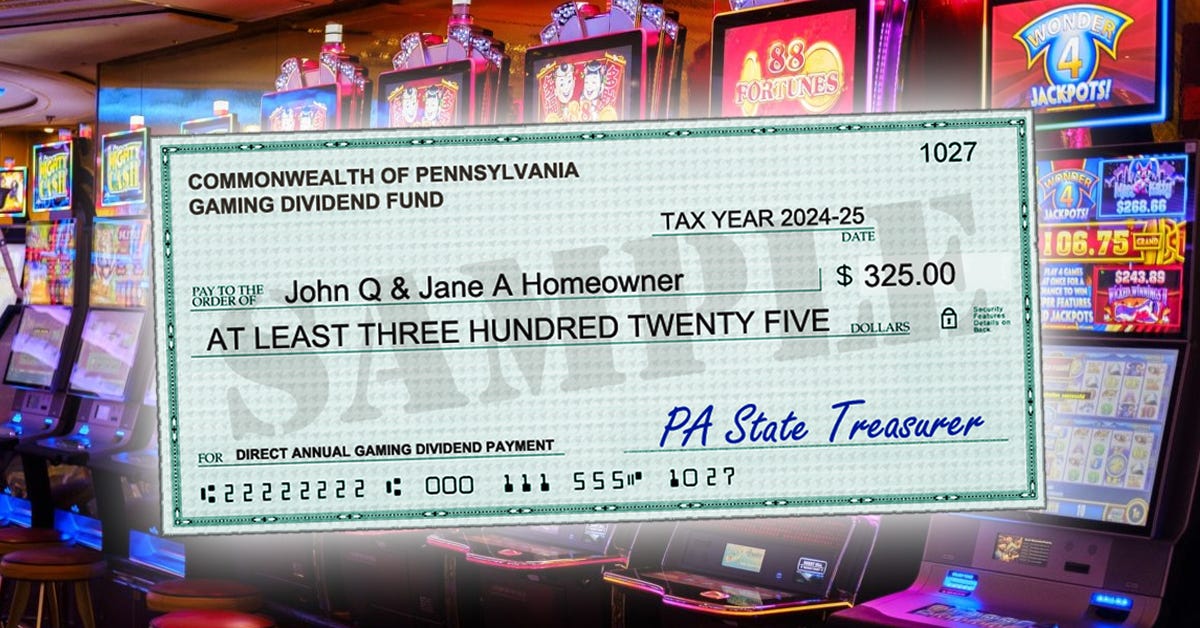

I will soon be introducing a bill to scrap this distribution plan. No more hard-to-find wealth distribution experiments with gaming revenue to paper over the horrific reality of property taxes. Instead, I believe the Commonwealth should send a DIRECT ANNUAL GAMING DIVIDEND PAYMENT to every qualified homestead/farmstead owner in PA, and every single one of them should be getting the exact same amount.

Such a check would have been worth around $325 last year. But we already know that the $931 million figure will grow to about $1.05 billion this year, and that gaming revenues keep setting records year after year. In addition, my bill will substantially increase the share of gaming revenue that gets tagged for direct relief for homestead and farmstead owners.

Wouldn’t you rather just receive a check or direct deposit every year than let Harrisburg politicians from 2006 dictate that a portion of your share should go to help pay somebody else’s property tax bill in another part of the state?

Agree? Disagree? I want to hear from you! Leave a comment or send a reply email! If you’re not following already, you can follow my official legislative Facebook page by clicking here. Come for the content, stay for the comments. Sometimes it gets a little heated over there!

Why?

Never got it. Didn’t qualify